Millennials want to have data readily available; it is no longer enough for a real estate agent to show a Millennial an assortment of areas with properties that have been handpicked by the agent in each area (Crittenden and Crittenden 2017). In the United States, Zillow has been a disruptive technology that offers real-time housing prices freely on the internet, similar services are now available around the world, in the United Kingdom, Zoopla offers a similar service.

Concerning legislation and acceptance of digital signatures, judiciaries around the world are moving toward the acceptance of electronic signatures and the validity of electronic agreements becomes ubiquitous. In England, the Court of Appeal detailed an examination of what constitutes a signed agreement in writing to satisfy s. 4 of the Statute of Frauds 1677. A Court of Appeal decision in Golden Ocean Group Ltd v Salgaocar Mining Industries Pvt Ltd. (2012) has established that an exchange of emails between two parties is deemed to be validly signed as a result of the email signatures used by the parties. The agreements were found to be legally binding without any formal document being signed. The electronic communication satisfied the requirements of section 4 of the Statute of Frauds which is an integral step toward the acceptance and legalization of smart contracts.

Canada passed the Uniform Electronic Commerce Act that allows for electronic signatures to be used in a technology-neutral environment and states that a physically written signature is not required to be legally binding and electronic contracts shall be admissible as evidence under the Canada Evidence Act.

In the USA, Pankratov et. al. (2020) finds over 50 major financial institutions have unified their resources to explore disruptive technologies including discussion of blockchain to replace the current SWIFT system.

Notwithstanding the aforementioned technical progress, the current real estate conveyance systems in Anglo-Saxon regions are archaic in comparison. They have limited data integrity, restrictive accessibility, and inaccessible data due to orphaned data. Property records systems are fractured and scattered, the systems do not interoperate well and integration between systems is inadequate due to the proprietary the legacy real estate systems in place. The epitome of the archaic nature of these systems has related the ability to access public data in an organized manner. Many jurisdictions are so dated that private companies collected and organize the publicly available data and sell the organized data back to government and industry members. The collection of these out-dated systems results in increased costs to the consumer.

In the modern context, one could describe the current systems related to the transfer of real estate as an illiquid conveyancing system, as it slow and difficult to transfer ownership of a property with opaque due diligence for many buyers. The use of blockchain and distributive file storage offer solutions to upgrade and improved the systems related to the conveyance of title.

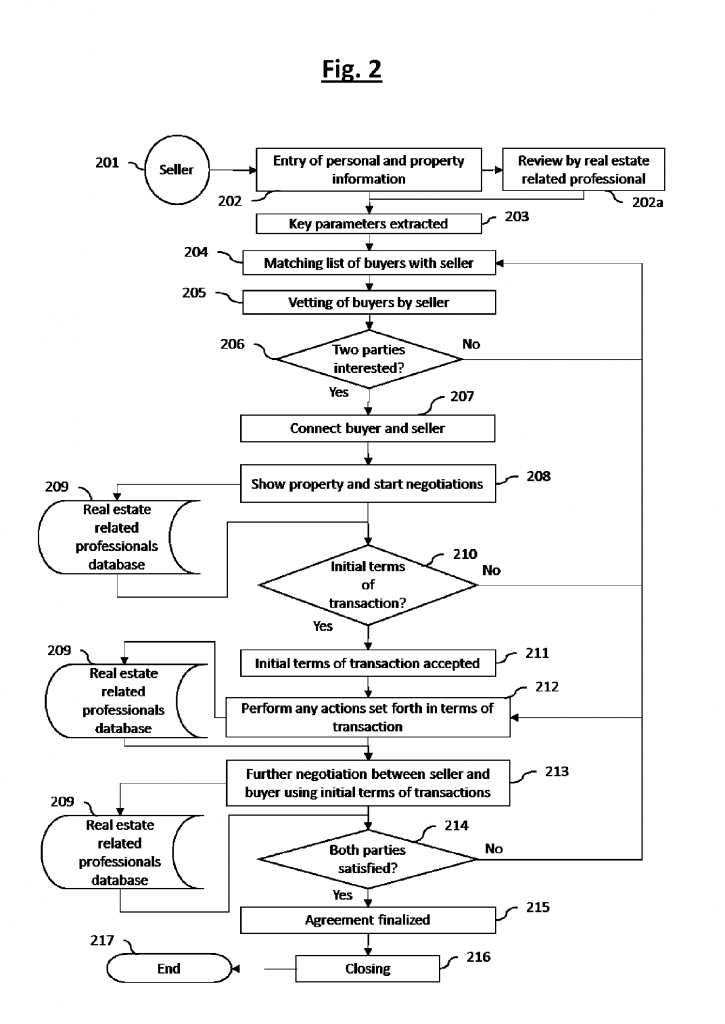

Another option for conveyance would be a peer to peer model as developed by Vaynshteyn and Lotwolf (2017). They obtained a US Patent for a digital system that facilitates peer to peer transactions in a variety of scenarios, below is figure 2 from their US Patent related to the connection of a Buyer and Seller in a prospective real estate transaction.

The implementation of either a peer to peer or blockchain real estate conveyance system will solve the fragmentation and centralization issues that plague the real estate industry. The use of blockchain and distributive file storage de-centralization you eliminate the monopiles for continued development and refinement for the conveyance of title. Savelyev (2017) refers to the system of decentralization as a Decentralized Autonomous Organization (DAO).

Wouda and Opdenakker (2019) find the three fundamental challenges the industry faces for implementing digital transformation are the immaturity of the technology, the lack of standardization, and the limited examples of successful application of technology.

We will be able to transfer property by means other than paper now and peer to peer transactions using blockchain are the inevitable digital solution. They allow real estate to be transferred through blockchain and distributed file storage will provide us publicly available open-source access, technologic unity, and decentralization.

References:

Crittenden, A.B., Crittenden, V.L., and Crittenden, W.F., 2017. Industry transformation via channel disruption. Journal of Marketing Channels, 24(1-2), pp.13-26.

Pankratov, E., Grigoryev, V., and Pankratov, O., 2020, June. Blockchain technology in real estate sector: Experience and prospects. In IOP Conference Series: Materials Science and Engineering (Vol. 869, No. 6, p. 062010). IOP Publishing.

Savelyev, A., 2017. Contract law 2.0: ‘Smart’contracts as the beginning of the end of classic contract law. Information & Communications Technology Law, 26(2), pp.116-134.

Vaynshteyn, G., Lotwolf Inc, 2017. Methods and systems for performing peer to peer real estate transactions. U.S. Patent Application 15/159,993.

Wouda, H.P. and Opdenakker, R., 2019. Blockchain technology in commercial real estate transactions. Journal of Property Investment & Finance.